Short-term car insurance has changed how drivers in the United Kingdom approach flexible, temporary vehicle cover. Instead of committing to annual policies, motorists now have the option to insure their vehicles for days, weeks, or even just a weekend. This tailored solution caters to those borrowing a friend’s car, sharing driving on a road trip, or needing coverage during vehicle repairs. The ability to precisely match insurance duration with actual need appeals strongly to cost- and convenience-conscious UK drivers.

At the heart of these policies is a streamlined application process and quick activation—often within minutes online. Coverage is typically fully comprehensive and flexible, spanning from as little as one hour to as long as 30 days. With multiple providers competing in the market, short-term policies offer not just convenience, but also potential savings compared to adding drivers onto existing annual plans or taking out long-term insurance for short use periods.

When comparing the leading providers for short-term car insurance in the UK, pricing is a clear differentiator, often determined by risk factors such as age, vehicle type, and duration. Cuvva and Zego stand out with their pay-by-the-hour options, allowing unmatched microflexibility and appealing specifically to those needing ultra-short-term coverage.

Tempcover, Dayinsure, and GoShorty have built reputations for streamlined apps and instant digital policies. The rapid approval process is a hallmark, helping drivers get legal and on the road in record time. Esure, Aviva, and Swiftcover add strength from their parent companies’ established presences, giving confidence to those who prefer trusted names.

Coverage limits, excesses, and restrictions can vary considerably. For example, some insurers favor experienced drivers and particular car types, while others extend options to younger drivers or offer limited add-ons like breakdown cover. The advantage of shopping across multiple UK-specific providers is the ability to fine-tune both price and policy benefits.

Recent consumer trends in the United Kingdom show a sharp rise in demand for flexible car insurance, with many young adults and city dwellers opting for short-term policies rather than maintaining annual cover. This evolution reflects broader shifts in car ownership habits and the growing popularity of car-sharing and peer-to-peer vehicle lending.

By weighing each provider's strengths in flexibility, price point, coverage, and reputation, drivers can pinpoint which short-term car insurance solution aligns most closely with their unique circumstances. The subtle distinctions between leading names grow more apparent as you examine how policy extras, customer support, and claim responsiveness play into the decision.

Unpacking these UK-focused offerings reveals a complex landscape—one where making an informed comparison goes far beyond price alone. The deeper details reveal even more valuable insights ahead…

The features and limitations that distinguish short-term car insurance providers in the United Kingdom are central to making the right choice. While all listed companies offer comprehensive cover as standard, each approaches policy add-ons, exclusions, and claims processes differently. For example, Dayinsure and Aviva include basic breakdown options, while others like Cuvva and Zego focus on pure insurance with added simplicity in their app-based interfaces. This allows drivers to match policies with their day-to-day needs rather than settle for a one-size-fits-all product.

Many providers in the UK, such as Tempcover and GoShorty, cater strongly to drivers seeking no long-term obligations. These firms hinge their proposition on easy cancellation and policy management—often searchable and adjustable on mobile apps or speedy online portals. This responsiveness particularly benefits city drivers and those with unpredictable schedules who may need instant cover for car rental, test drives, or temporary vehicle use.

Insurance excess is another comparison point. GoShorty and Insure4aDay typically set excesses around £250–£500 depending on personal circumstances and the selected vehicle, while established brands like Aviva and Esure can sometimes offer slightly lower default excesses in exchange for higher premiums. UK drivers should balance the excess level against premium cost to avoid unpleasant surprises in the event of a claim.

Vehicle eligibility criteria also separate the providers. While most cover privately owned cars, some—such as Zego—accommodate commercial use and taxis. Others, including heycar Temporary Cover and Swiftcover, may have tighter restrictions related to vehicle age, value, or engine size. Reviewing eligibility ensures that the desired car is insurable, particularly for newer or specialist vehicles common in the UK market.

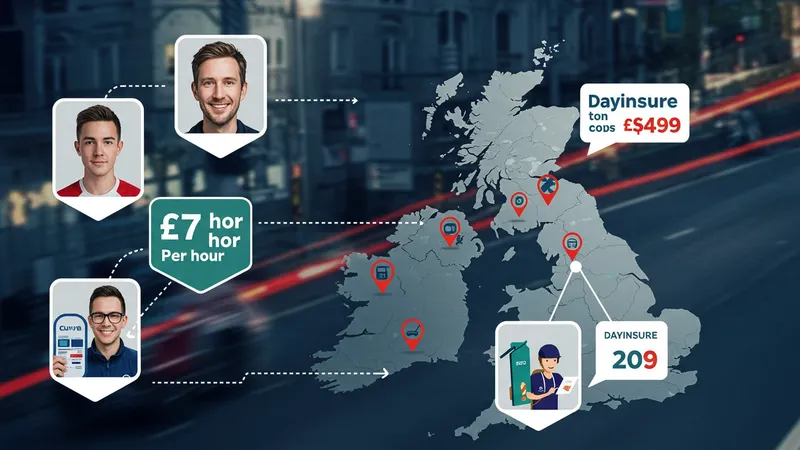

The price you pay for short-term car insurance in the UK isn’t just a flat fee—it’s the outcome of several key factors: driver age, driving history, vehicle type, location, and duration of cover. For example, Cuvva may quote as low as £7 per hour for drivers over 21, while Dayinsure’s day rate starts at £25. Zego’s hourly pricing opens access to those needing coverage for gig work or brief personal trips, which is rare among traditional providers.

Tempcover and GoShorty offer value for drivers looking at periods longer than a single day, with decreasing per-day costs for policies of a week or more. Insure4aDay and Esure Temporary Car Insurance position themselves slightly higher on price but may offer enhanced customer service and broader coverage options as justification. Drivers must weigh whether the additional features offset the higher daily premium.

For anyone under 25 or without a lengthy driving record, premiums across all providers climb sharply, with GoShorty and Swiftcover sometimes offering more inclusive options for young drivers than their competitors. This underlines the importance of inputting your exact data for an personalised quote rather than generalising via headline rates found across the UK market.

Temporary policies can also offer a financial edge when compared to the costs of amending or cancelling annual insurance to accommodate new driving needs. UK drivers increasingly appreciate how these flexible products solve irregular, short-term needs without risking no-claims bonuses on longer policies or incurring punitive admin charges for changes.

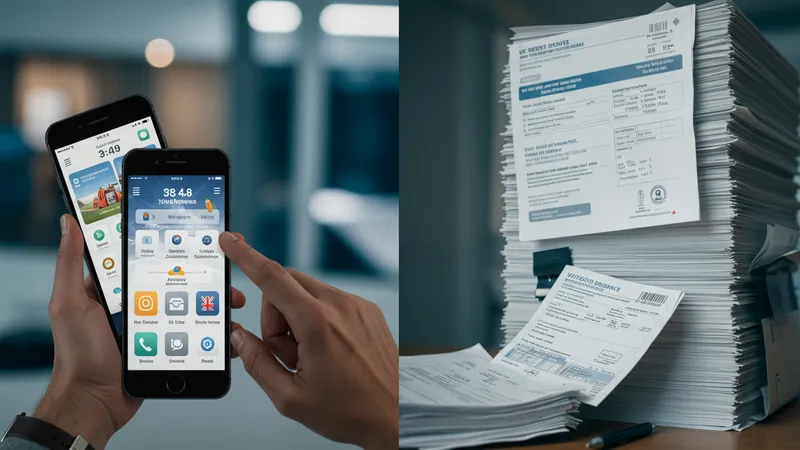

Modern UK insurance providers such as Cuvva and Tempcover have invested heavily in user-friendly apps. For many drivers, the entire application—quotation, payment, policy document, and even claims notification—happens on a smartphone within minutes. This digital-first approach stands in sharp contrast to the slower, paperwork-heavy processes of legacy insurers and is especially valued in urgent situations like unexpected vehicle use or last-minute rentals.

Meanwhile, brands like Aviva and Dayinsure cater to customers who favour web-based management. Their portals are tailored to speedy application times, often under 10 minutes, while maintaining traditional levels of service help. Swiftcover and heycar Temporary Cover blend both app and browser technologies, trying to balance ease-of-use with thorough policy information for peace of mind.

Customer reviews highlight real differences in the responsiveness and clarity of these digital journeys. Cuvva’s chat-based support system enables on-the-go assistance, while others gravitate toward phone support or email communication. This variety allows UK drivers to prioritise what matters—whether instant policy issue, clarity of documents, or accessible claims support.

Providers like GoShorty and Zego are continually adding new features, from real-time policy tracking to direct integration with telematics or rideshare platforms. These innovations directly respond to the needs of modern UK motorists and hint at the coming evolution in short-term car cover services.

Deciding among the top short-term car insurance options requires careful consideration of both individual needs and the distinct features each provider offers. Drivers who prioritise affordability and schedule flexibility may lean toward Cuvva or Zego thanks to their per-hour pricing. For those who expect longer periods or want additional options like breakdown cover, Tempcover, Dayinsure, and Aviva present strong, reliable choices.

If policy management and a seamless app experience are top priorities, then modern digital-first brands such as Cuvva, GoShorty, and Tempcover stand out. On the other hand, drivers who feel more comfortable with established companies may prefer Swiftcover, Esure, or Aviva, which reveal a greater focus on customer support and varied add-ons. This diversity reflects the broader UK insurance landscape: from nimble newcomers to time-tested giants.

Consideration of fine details like excess amounts, add-on packages, customer reviews, and coverage restrictions ensures drivers select a policy that truly matches their real-world usage. For instance, someone lending a vehicle to a friend for a weekend will value a different package than a city professional needing cover for a rideshare vehicle on busy weekdays.

Ultimately, as the UK’s car ownership model grows more fluid—with more city dwellers and younger drivers eschewing long-term arrangements—the importance of temporary insurance will only rise. With information above, any motorist in the UK is equipped to compare, contrast, and choose a provider suited for their needs today and the emerging trends of tomorrow.