Imagine a savings account that pays you to save! Sounds impossible, right? But in Bangladesh, innovative banking solutions are making the impossible, possible!

In 2025, understanding savings account options is crucial as financial landscapes shift globally. This affects us all more than you'd ever expect. So buckle up—because these revelations could alter how you handle your finances forever!

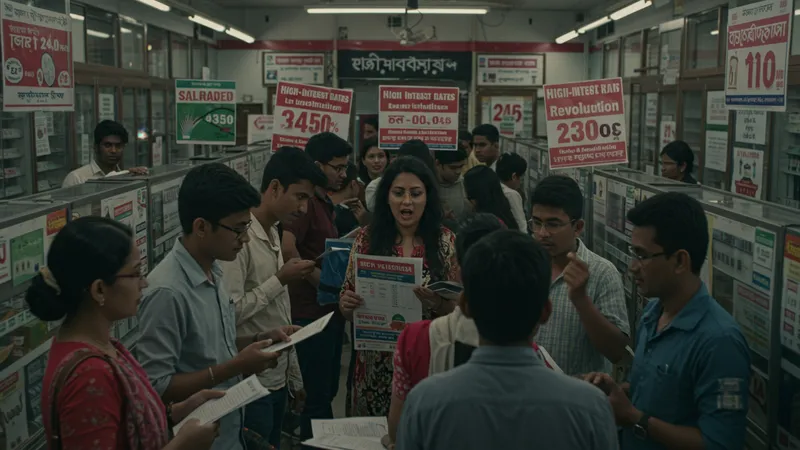

In a remarkable twist, some savings accounts in Bangladesh are offering interest rates so high, they're turning heads globally. These rates aren't just keeping pace with inflation—they're outpacing it, giving account holders unprecedented earning power. But that's not even the wildest part...

Contrary to what you've been told, some banks are introducing zero-fee savings accounts with AI-driven savings advice. Yes, they're leveraging artificial intelligence to maximize your interest earnings. What this means for traditional banking is groundbreaking. But hold on to your hats, because what happens next shocked even the experts…

High-interest rates aren't just a dream—they're becoming a reality in Bangladesh's financial market, allowing citizens to combat inflation effectively. The banking sector is being forced to adapt, creating more competitive options for savers. What's more, funds that would typically sit and stagnate are now growing exponentially.

This shift is igniting a financial revolution, as more people flock to these high-yield options. It's a win-win for consumers who now have the upper hand in choosing banks that truly serve their needs. The change might seem radical, but there's one more twist you’ll want to know.

Behind closed doors, banks are using innovative technology to ensure the high rates are sustainable, ensuring security for both the banks and the customers. The blend of technology and finance is crafting solutions unimaginable a decade ago. Curious yet?

The demand is so staggering that some experts predict a new wave of global investors targeting Bangladeshi banks. This isn't just local—it’s a financial phenomenon with rippling effects worldwide. But wait—what you read next might change how you see this forever.

Skeptical about bank fees? You’re not alone. That’s why major Bangladeshi banks are eliminating them altogether in some accounts. Yes, you heard right—zero fees. In a quest to attract customers, banks are completely waiving certain fees that were once thought unavoidable.

This movement is not merely about slashing costs; it's a dynamic shift to boost customer satisfaction and retention. Imagine not having to worry about monthly fees nicking at your hard-earned savings. Tempting, isn't it? But there's another twist underneath the surface...

Banks are cleverly compensating for these fee losses by encouraging increased account usage through AI savings strategies, which not only grow savings but also enhance the bank’s profitability. With this model, trust in banks is soaring to new heights.

The implications? Conventional banking norms are being turned upside down. Zero-fee accounts are bringing a financial empowerment previously unheard of. And yet, that’s just skimming the surface of what’s to come. Continue reading because you won’t believe what’s next!

In an unexpected turn of events, AI has infiltrated personal finance in Bangladesh. Banks are offering AI-powered advisors that analyze spending habits to suggest personalized savings strategies. Yes, this virtual assistant in your pocket is revolutionizing how people save.

Think of it as a savvy financial coach, available 24/7, taking into account various indicators to optimize your finances. It’s like having a financial guru whispering the best deals and hacks into your ear. But the best part is yet to come...

Unlike human advisors, AI works tirelessly, crunching vast amounts of data to provide the best advice possible. It’s impartial, precise, and tailored just for you. Suddenly, managing money seems not only feasible but also exhilarating.

It's a digital age marvel that's redefining how financial wisdom is dispensed. And, surprisingly, it's catching on faster than anyone expected. What’s the catch? You'll have to keep reading to uncover an enticing twist.

Bangladesh is witnessing a meteoric rise in mobile banking, offering unparalleled convenience to users. The last few years have seen a 60% increase in mobile app transactions—an unprecedented shift in how people manage money.

This growth is largely due to the country's robust internet penetration and affordable mobile technologies. Consumers can now execute a range of banking tasks effortlessly from the palm of their hand. But mobile banking has another game-changing advantage...

Security features have evolved, with biometric authentication ensuring that your transactions remain safe and sound. Combine this with instant notifications, and you're in control of your finances like never before.

Yet, some skeptics question this rapid shift, wondering if traditional banking’s days might be numbered. Stay tuned as we unravel the unexpected consequences of this digital surge.

Imagine a bank where your savings contribute to ethical investments. Yes, you can now choose banks that promise to use your money for socially responsible projects. Ethical banking is gaining traction, changing the relationship between banks and customers.

No longer just about interest rates, these banks are rewriting the rules to focus on sustainability and ethics. Customers are loving the idea of savings that serve a greater good. But why stop at ethical banking?

This shift is creating fireside conversations among banking executives, pressing everyone to find innovative ways to marry profit with purpose. It's spurring a newfound respect for banks committed to people and planet.

While critics argue that profit might suffer, early indicators suggest otherwise. Customers are proving that they value principle just as much as profit. So, what’s the next big leap in banking practices? You’ll be astonished by what we found out.

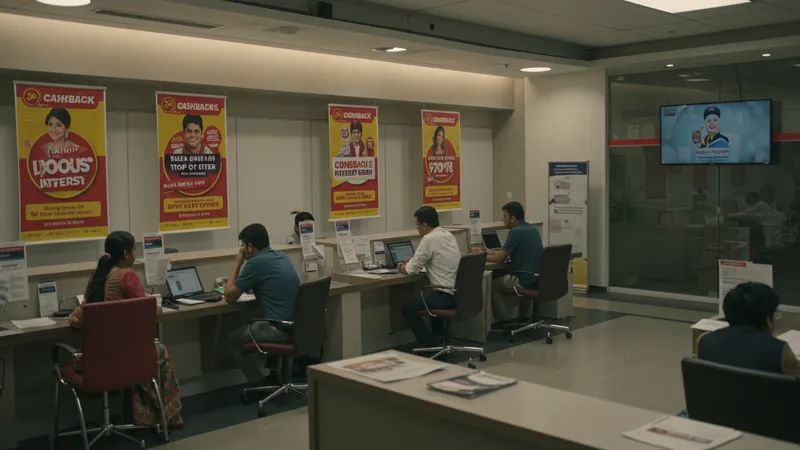

Welcome to the new era of banking incentives in Bangladesh! With savings interests gaining traction, banks are scrambling to offer enticing rewards—think cashback on your deposits and bonus interest rates.

Imagine being rewarded just for storing your money securely. This isn't just a fantasy; it's the reality for savvy savers who shop around for the best deals. But incentives are not stopping with financial perks...

Financial institutions are getting increasingly creative with loyalty programs that offer everything from travel rewards to discounts on shopping. This shift is redefining how we view our relationships with banks.

And with these unprecedented perks on offer, customer satisfaction is shooting through the roof. But there's a surprising twist in the incentive tale you’ll not want to miss...

Bangladeshi banks are rolling out innovative financial products designed exclusively for keen savers. Say hello to savings accounts with built-in investment options and flexible withdrawal terms.

This remarkable diversification is not only driving growth but also providing savers with varied avenues for increasing wealth. It's astonishing how banks are adapting with the times.

No longer are savings merely stagnant funds; they are dynamic resources that can be actively managed for growth. However, the real surprise lies in the nascent technologies supporting these innovations...

These products are deploying artificial intelligence and machine learning to offer personalized financial strategies unheard of a couple of years ago. Curious about the latest breakthrough? You haven't heard the half of it yet!

In an unexpected turn, smaller, lesser-known banks in Bangladesh are shattering notions of who provides the best savings deals. By leveraging technology and offering unbeatable rates, these institutions are drawing an unprecedented number of new customers.

Their hands-on approach and readiness to embrace risk have led them to offer more tailored solutions, thereby challenging the dominance of established giants. But they have one other ace up their sleeve...

Their service quality goes unmatched, offering a personalized banking experience that larger banks struggle to emulate. As the banking battleground evolves, this could signify a monumental shift in consumer trust.

Some analysts believe these underdogs are reshaping the competitive landscape, fostering innovation and competition across the industry. And there's yet another element transforming the game... Discover more as we dig deeper!

In recent times, the banking sector in Bangladesh has seen a regulatory surge focusing on maintaining transparency and security. New laws are pushing banks to become more customer-oriented, fostering trust like never before.

This increased regulation aims to safeguard customer interests while modernizing the financial infrastructure. It's a crucial stepping stone towards a more secure banking environment. Still, there's an unexpected layer to it...

These regulations are fostering unforeseen alliances between banks and fintech companies, aiming to deliver superior financial products and services. This collaboration can only mean one thing for consumers...

Beyond securing funds, these joint ventures offer groundbreaking advancements and conveniences never before experienced. The landscape is shifting, and this is just the beginning of what regulatory actions hold in store. Hang on, there's more to explore.

Despite all the benefits, these advanced savings options come with their share of surprises. Navigating these new waters can be overwhelming, and without guidance, customers may find themselves in tricky financial situations.

For instance, the slew of choice can lead to indecision, with consumers unsure which way to turn amidst so many attractive offers. But there's an even bigger hidden risk no one's talking about.

Over-innovation risks overwhelming traditional banking practices, pushing some consumers away from tech-driven change due to fear or mistrust. This blurs the line of comfort for many bank loyalists.

While innovation often carries the promise of a better future, consumers must stay savvy and informed to avoid falling into unforeseen pitfalls. Speak of surprises, there’s an aspect not yet covered...

The newfound financial freedom afforded by enhanced savings accounts is life-changing. People now enjoy unprecedented control over their finances, which directly translates into increased well-being and life satisfaction.

This sense of control is offering more than just monetary value. It’s becoming an emotional safety net, curbing stress linked to financial insecurity. Yet, like all things wonderful, there’s more beneath the surface...

The overabundance of options can sometimes contribute to anxiety, leaving some feeling lost amidst the promises of prosperity. Finding balance becomes vital in navigating this brave new financial world.

The implications? Understanding how this freedom impacts mental health will require thoughtful consideration. Delve deeper to uncover the complexities of having more choices.

In this evolving economic climate, smart strategies for maximizing your savings are vital. Start by comparing high-yield accounts and leveraging financial tools for optimal interest benefits.

Consider adopting AI-driven financial advisors to monitor and augment your investment growth efficiently. They are particularly useful in managing the labyrinth of options available!

Plot out withdrawal needs carefully to avoid penalties, and research ethical banking options to ensure your money aligns with your values. These steps might seem straightforward, but one more strategic tip might surprise you.

Stay updated on banking trends by engaging with financial news and predictions. They provide insights that could significantly affect your savings strategy, ensuring you're always a step ahead. Now, for the thrilling conclusion...

The foundational shifts happening in Bangladesh's banking sector are setting the stage for a new era of financial prosperity—rightfully referred to as Bangabandhu’s Banking Moment.

This scenario is striking because it not only signifies economic growth but also represents a pivotal point in redefining the financial security of millions. But here's the twist—these developments hold potential beyond the obvious monetary gains!

The ripple effects of 2025's banking innovations may pave the way for groundbreaking cultural shifts in saving behaviors and approaches to personal finance.

As you venture further into this fascinating financial future, remember: change isn't just inevitable; it's already here. And the surprises that await? They're just the beginning, leaving us with one last yet crucial impression...

Indeed, with these unexpected shifts in Bangladesh's financial landscape, the era of old is giving way to a future ripe with promise and potential. But are you ready to embrace what's next and harness the opportunities these savings accounts present? The tools and knowledge are at your disposal. Go ahead, dive into this brave new world of finance, and empower yourself to create the financial future you've always dreamed of. Don't keep this treasure trove to yourself—share with friends and fellow savers, and be a part of the financial revolution happening now!