You won't believe what a secret investigation revealed about student loans in the U.S. This everyday financial burden hides a jaw-dropping secret that could change your perspective forever.

Why are student loans spiraling out of control, leaving millions in financial turmoil? As tuition costs soar, this issue demands our attention more than ever.

Most people assume student loans are just a temporary hurdle, a rite of passage for those pursuing higher education. However, these financial traps can haunt graduates for decades, quietly consuming their salaries. Shockingly, over 44 million borrowers in the U.S. owe a collective $1.6 trillion in student loans. But that’s not even the wildest part…

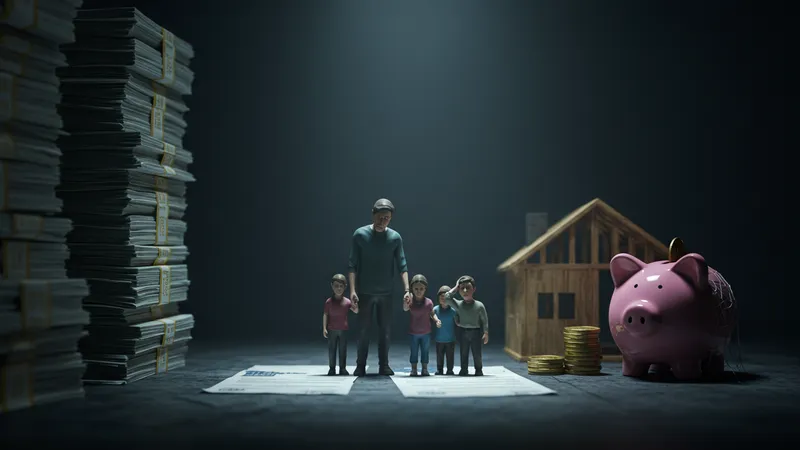

Parents often sacrifice their retirement savings to ensure their kids don't carry the burden. But the unforeseen consequence? An entire generation faces financial instability due to these all-consuming debts. But hold on, the story doesn't end there…

The implications of the current student loan crisis are more profound than experts initially predicted. What happens next shocked even the experts…

When we talk about affordable education, many don't consider the hidden costs. Universities advertise reasonable tuition fees, but the supplies, housing, and other unforeseen expenses can easily double or triple the expected costs. Students walk into these institutions with a false sense of financial security, only to be blindsided when they graduate. Here’s the twist: tuition isn’t the only financial burden awaiting students.

Let’s delve into how textbooks, considered by many as essential tools for learning, add an average of $1,200 annually to the financial burden. This figure is often omitted from initial financial plans, catching students off guard. Some opt to buy second-hand, but with new editions frequently published, is it enough? But there’s one more twist…

Consider the interest rates on student loans. Many borrowers start with a manageable amount, only to see it balloon as compound interest works tirelessly against them over the years. Did you know that some graduates pay more in interest than they initially borrowed? This revelation makes many rethink borrowing strategies. But what you read next might change how you see this forever.

The effect of student loans permeates beyond individuals; it impacts families, communities, and the economy. Parents attempting to support children through school often tap into their retirement savings. So, when the children graduate, both generations feel the financial pinch. There’s even more to ponder in the pages ahead.

Interest rates may seem negligible upfront, but they quietly accumulate over time, turning manageable loans into financial nightmares. Fixed rates guarantee consistency, yet variable rates can skyrocket unexpectedly, often shocking borrowers unprepared for the hike. The real issue lies in understanding these interest nuances. Are you focusing on numbers over your future financial well-being?

For some, refinancing offers a refuge, seemingly providing a lower rate or better terms. However, it’s crucial to calculate what you’ll end up paying over the life of a loan before opting in. Many end up paying more due to simple miscalculations, and refinancing would do little to mitigate unforeseen changes. But what does this mean for potential borrowers?

The government offers various repayment plans suited to different financial situations, but they rarely address the roots of the problem. With options like income-driven repayment plans capping payments at a percentage of income, it appears like a win at first. Yet, ballooning interest could eventually offset these benefits and leave people wondering what their degrees are truly worth. So, what’s next could be surprising…

Even though scholarships and financial aid are accessible, they are not foolproof solutions. Many students, keen to avoid escalating debts, rely on these aids, but the fierce competition limits their reach. After all, thousands aim for the same relief. They might provide a head start, but they aren’t the alchemist’s stone we wish for. Are there other solutions waiting to be discovered?

Financial literacy, alarmingly, isn't a focus for most students. They’re expected to make huge financial decisions without adequate education. Schools often glance over crucial lessons on budgeting, credit, and loans, leaving students to learn on the fly. What if educational institutions focused more on comprehensive financial literacy programs?

In response to this demand, many independent platforms now strive to arm students with knowledge. Websites like Investopedia and Khan Academy offer guides and courses in finance. Yet, the uptake is slow due to the volume of immediate academic work. Could these extra resources bridge the gap and make a significant impact on financial planning for students?

Parents play an integral role, not only contributing financially but by guiding and advising their children. While some promote the mantra “learn from my mistakes”, many avoid open discussions about their financial mishaps. Encourage open dialogues about money—it might surprise you how receptive the younger generation can be.

Some states and institutions are catching on, incorporating financial literacy into curriculums with positive outcomes. Knowledge is power, and empowering students with the right tools and information could fundamentally alter their future financial landscapes. But can this trend gain enough momentum before the debt spikes further?

The value of a college degree is under intense scrutiny. Rising tuition costs and soaring student debts make many question the worth of a traditional four-year college education. Are alternative education paths, such as vocational training or online certifications, becoming not only viable but preferable?

With innovations in technology and the rise of digital nomads, skills seemingly outrank degrees in certain industries. Tech behemoths like Google and Apple prioritize skills and experience over paper qualifications. This shift raises the question: is investing in a degree still the golden ticket to career success?

Despite the change, prestigious universities continue to draw in candidates willing to shoulder the costs, believing the alumni network and brand visibility will offer returns on investment. But not all graduates find this narrative true. The employment struggle among new graduates is stark proof of the narrative gap.

The question isn't just whether a degree is worth it but also how society and industries measure success. The definition of a successful career is evolving rapidly, aligning more with real-world skills and adaptability. Could adapting our education system to reflect this shift translate to reduced student debt?

As companies compete for top talent, offering educational benefits has become a powerful recruitment and retention tool. More employers are now offering scholarships, tuition reimbursement, and loan repayment assistance as part of their benefits packages. This trend is quietly gaining momentum—could it change the educational landscape?

The attraction doesn't lie solely in relieving financial burdens but also in fostering a culture of continuous learning and development. Employees encouraged to pursue higher education through company-supported programs often perform better and exhibit increased loyalty. Could embracing this practice widely revolutionize corporate culture?

However, it's not just big corporations making the change. Small businesses are finding unique ways to participate in this educational support system, sometimes partnering with local colleges to create tailored courses benefiting both the company and the employee. Could this small-scale impact create a ripple effect throughout the industry?

With a growing number of people benefiting from employer-initiated scholarships, the workplace is transforming into a dual space for professional and personal growth. This model of constant learning could redefine career paths and in turn, question the necessity of traditional, debt-inducing educational models. But is this enough for an educational revolution?

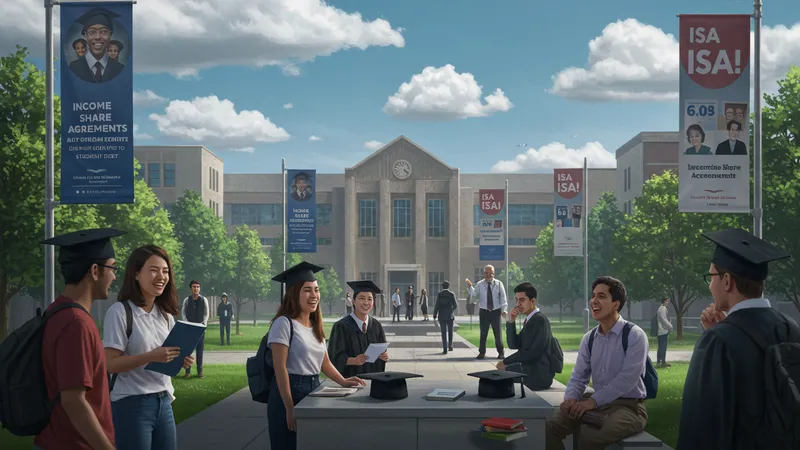

Income Share Agreements (ISAs) are emerging as a promising alternative, where students agree to pay a percentage of their future income for a set number of years instead of accruing traditional debt. Universities like Purdue have started adopting this model, sparking debates and interest nationwide. Could this innovative approach solve the student debt crisis?

Proponents of ISAs argue that this model aligns the interests of universities with those of students, making institutions more invested in graduates' success. However, critics warn of potential pitfalls, such as excessive repayment burdens and predatory terms, casting shadows on this seemingly flawless solution. What’s the truth in between?

For students, ISAs offer a form of insurance against unemployment and underemployment, as repayments are contingent upon earning a minimum income. Yet, only a limited number of institutions offer these agreements, creating a competitive atmosphere among students wanting to benefit. Can ISAs actually become widespread enough to make a significant impact?

While ISAs present a tantalizing opportunity to reshape financing education, challenges around standardizing terms and ensuring fair contracts remain. The potential is vast, but its real-world application reveals complexities. Could refining this concept and widespread implementation not only offer a solution to debt but a new way of defining educational value?

As the crisis looms large, federal interventions could provide relief. Recent legislative proposals suggest sweeping reforms in how student loans are regulated and managed, with potential cancellation or reduction of debts earning spotlight attention. As enticing as these ideas are, is there a chance for them to materialize into concrete policies?

Politicians increasingly leverage student loan reforms in their campaigns, promising to ease debt burdens. While such promises galvanize voter enthusiasm, the path to implementation remains complex and fraught with hurdles. Have these well-intentioned policies ignited hope, or are they merely political tools?

Efforts to cap interest rates, enhance loan forgiveness programs, and push for employer contributions are on the agenda, yet political polarity keeps many legislative attempts stuck in gridlock. The potential shifts hang in suspense, posing the question: could cross-party collaboration make meaningful legislative progress achievable?

Recent global events have sparked a reevaluation of educational funding structures worldwide. Observing international models of student finance could inspire innovative legislative approaches. With a worldwide crisis coloring every decision, could collaboration and innovation herald a new era for educational funding?

While U.S. students brace under the weight of student loans, global peers face different challenges. Countries have adopted a variety of approaches, from free tuition in some European nations to income-contingent loans in Australia. Studying these systems illuminates alternative pathways potentially adaptable for the U.S.

In countries like Germany, where education is nearly free, high-education inclusivity appears tied to positive societal outcomes, sparking debates over possible U.S. transitions. But are these systems as flawless as they seem, or do hidden challenges lurk beneath the surface, unnoticed by many?

Conversely, Australia's income-driven repayment plans offer lessons in managing debt responsibly, as payments shift based on actual earnings, maintaining financial flexibility for graduates. Could such adaptive repayment models be key to sustainable educational funding globally?

Cultural attitudes toward education and debt play crucial roles, too. In societies placing high value on education, debt is perceived as a worthwhile investment, despite hardships. Observing these cultural nuances can widen the lens through which student debt is understood, hinting at profound implications for policy-making in the U.S.

In an era dominated by tech prowess, managing finances through digital platforms is becoming standard practice. Platforms such as Mint and NerdWallet offer invaluable tools for both current students and graduates navigating the stormy seas of student loans.

Personalized financial advice through AI-driven applications aids borrowers in making informed decisions, scheduling payments, and understanding complex loan terms. The power is in users' hands, but are they effectively utilizing these resources? Is technology a genuine ally?

Peer-to-peer lending platforms are emerging as formidable players, offering new borrowing options at competitive rates. These platforms circumvent traditional banking systems, offering students an alternative avenue to fund their studies. But as enticing as they sound, could there be hidden risks associated with this seemingly open-source financial aid?

In this fast-evolving arena, technology continues to play a pivotal role in transforming the landscape of student loans. As digital solutions evolve, they promise to redefine financial management. The question remains: are we ready to embrace and trust technology in such high-stakes areas of life?

Beyond the financial strain, student loans weigh deeply on borrowers' mental health. The stress leads to anxiety, depression, and even physical ailments, manifesting realities often overlooked in economic discussions. Understanding this hidden impact prompts the critical question: are we truly supporting students' holistic well-being?

Knowing that debt might hinder major life decisions such as home ownership, marriage, and starting families, borrowers face pressures not just tied to finances but also future planning. Are societal expectations misaligned with the challenges faced by student debtors?

Support networks play a vital role, yet many borrowers feel isolated in their struggles, trapped in silent battles with mounting debt. Is an emotional support gap widening between borrowers and non-borrowers, creating a societal divide around financial experience?

Awareness, openness, and vulnerability might offer solace to borrowers, reaffirming they're not alone in their struggles with debt. As solutions evolve, addressing emotional and mental health alongside financial rehabilitation must rise to the forefront of the conversation. But will this broader approach be embraced across sectors?

Student loan forgiveness programs stir hope, promising relief and resurgence in financial security. But navigating this landscape is tricky, filled with complex criteria and long waiting periods. As optimism grows, potential borrowers are asking: are these programs as accessible and effective as envisioned?

Public Service Loan Forgiveness is a beacon of hope, yet the application success rate remains dismally low. Often, misalignment in qualifying employment or misunderstanding of the requirements dampens hope. Is there a path to simplifying these programs to ensure more graduates can benefit?

As reforms gain momentum, the debate intensifies. Some advocate for clear, attainable criteria; others focus on automatic eligibility post-qualification periods. As policymakers wrestle with plans, could rapid reform spark a national shift in how student debt is perceived and managed?

Many borrowers navigate this realm in confusion, questioning eligibility and presentation of these programs. Clear and consistent guidance could act as a beacon in the murky sea of student loan management. Will forward-thinking policies emerge and shift the landscape of student debt resolution once and for all?

The staggering $1.6 trillion student loan burden reverberates within the overarching economy. With borrowing costs eroding disposable income, many graduates hold back on investing, spending, and contributing to economic growth. These unseen economic ripples pose the critical question: could eliminating or reducing this debt charge the economy forward?

Recent studies reveal how significant loan burdens prevent home ownership, delay retirement savings, and stagnate consumer spending. As these economic activities halt, potential GDP growth prospects also diminish. Can a strategic intervention in student loans herald a newfound economic optimism?

Critics argue that debt cancellation will burden taxpayers and inflate national deficits. However, a nuanced analysis reveals how unlocking trapped capital within the younger demographic could spur innovation, entrepreneurship, and revitalization. The scale of economic recovery linked to tackling the debt crisis is immense.

By addressing the student debt debacle, we wouldn't just alter individual financial futures but could realign economic pathways nationwide. Whether these economic scenarios turn into reality hinges on a blend of policy shifts, systemic reforms, and national determination. Will bold steps echo forward into real change?

As we unravel the complexities of student loans, one fact is obvious—it's a multi-faceted issue requiring equally varied solutions. From financial literacy and policy reforms to technological innovations and cultural shifts, a symphony of strategies is needed to address the issue.

What lessons can we take away? Awareness and proactive management of financial futures stand at the forefront. Introducing comprehensive financial planning before college can arm students against debt. Yet, we must consider systemic and cultural shifts as integral components of the solution—a call for collective problem-solving could drive meaningful change. Society’s approach to education, economy, and well-being must evolve to accommodate emergent realities of student loans. It's time to forge new paths, exploring innovative solutions that align education with financial sustainability. It’s a bold vision, but as collaborations blossom and reforms ignite, the future might just hold fewer burdens and more promise.

Encouraging dialogue, sharing insights, and leading initiatives is imperative. If you found this analysis enlightening, share it with others. Let's shape a future where education doesn't equate to financial shackles. The journey towards debt-free education begins now!